This section will discover the several sorts of liquidity and their traits. Exchange liquidity refers again to the liquidity supplied by forex exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). These exchanges present liquidity by matching consumers and sellers of foreign money futures and choices. Exchange liquidity is considered more reliable than retail liquidity but much less dependable than interbank liquidity. These swimming pools are not decentralized, and traders should belief the change to carry their belongings. Centralized liquidity pools are in style amongst institutional investors and high-frequency traders because of their high liquidity.

A low short-term liquidity score means that the security is much less likely to be bought on the open market. Market depth liquidity refers back to the variety of orders which might be obtainable at totally different prices available within the market. A deep market has a lot of orders at various prices, which implies that there’s a excessive degree of liquidity. This sort of liquidity is particularly essential for large traders who have to execute trades in large quantities with out transferring the market worth.

Increase Of Buying And Selling Exercise

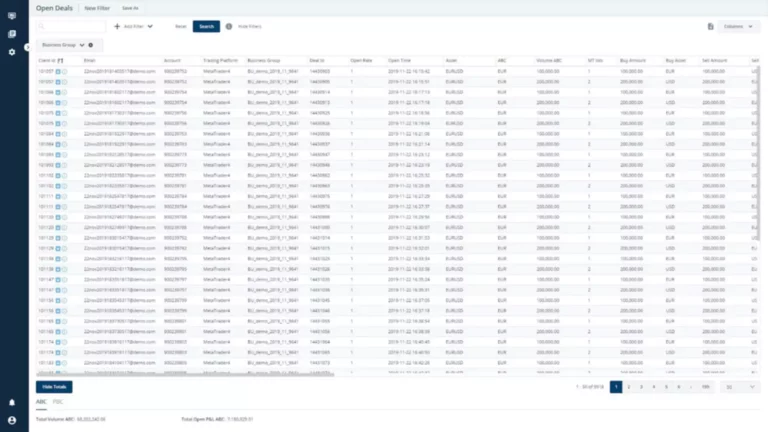

There are quite a few high-calibre foreign exchange worth aggregation, and distribution platforms relied on by brokers worldwide. However, as a outcome of fragmentation of the wholesale liquidity sector, aggregation is tricky. Many brokers consider when adding LPs into their community, the extra the merrier.

This allows traders to execute large orders with minimal worth impression, main to better buying and selling conditions and increased profitability. This dealer receives the order and lets market know that there’s an order to fulfill. Liquidity providers then make a suggestion to the broker who processed the order from which, the dealer chooses one of the best provide. The broker finalizes the client’s order utilizing liquidity from the liquidity provider that supplied one of the best supply.

A startup that’s further along in its development might have the ability to help itself through its revenue and/or property, but may still want to seek exterior financing so as to grow additional. During times of market stress, lenders might turn into more reluctant to lend, and borrowers could have issue accessing credit score. This can result in a liquidity crisis, which may have severe consequences for monetary establishments and the broader financial system. As expertise advances, AI-driven algorithms may more and more dominate liquidity provision, resulting in even tighter spreads and more efficient markets.

The Transformative Power Of Blockchain In Banking: Use Instances And Benefits

Understanding the functions they provide is important for everyone that is looking for environment friendly execution, market stability, and lowered transaction costs. With their reasonably priced pricing, tier-1 liquidity channels, complementary digital solutions and razor-sharp spreads, PoPs will assist you to get a powerful start within the highly aggressive brokerage area of interest. Judging from the important components said above, mid-sized companies would benefit liquidity pool forex the most from partnering with Prime of Prime LPs. Before the PoP providers entered the market, mid-sized brokerages have been stuck in the no man’s land equivalent of liquidity. Tier-1 suppliers are just too expensive, and regular LPs can’t satisfy the increasingly advanced calls for of aggressive brokerages. As a end result, your brokerage agency can avoid creating in-house solutions and bloating your business bills.

- There are a quantity of various kinds of liquidity funding for startups, and it is very important research every option earlier than deciding on one.

- However, retail and change liquidity are additionally important sources of liquidity, especially for retail merchants.

- Non-Bank Market Makers – Non-Bank Market Makers (NBBMs) are financial institutions that act as intermediaries between consumers and sellers in the trading market.

- In the instance above, the rare e-book collector’s belongings are comparatively illiquid and would in all probability not be worth their full value of $1,000 in a pinch.

- Through their provision of deep liquidity, they permit traders to enter and exit positions with minimal price impact.

- To mitigate this risk, parties usually carry out thorough credit assessments and may require collateral or guarantees from the counterparty.

To maintain worldwide markets wholesome, there are strong liquidity providers, market makers, and brokers. Liquidity providers make sure that the market has tradable forex pairs and provide pricing information. While brokers link merchants to liquidity providers and execute trades on behalf of the merchants. Understanding the several sorts of liquidity providers in ECNs is essential for traders and traders.

Liquidity Options

Before looking for a liquidity companion, it is crucial to understand your own enterprise mannequin and long-term aspirations since it will drastically simplify the choice process. Many LPs, including PoPs and regular LPs, have specialised companies that match totally different sectors. So, before committing to any single companion, decide your needs and requirements. Without a huge selection of foreign money choices, your brokerage business will not be able to satisfy institutional traders and most retail merchants, leaving you with a reasonably limited target market.

We are one of many few Prime of Primes that offers a very seamless multi-asset liquidity providing masking pricing, market information and robust executions. Brokers and merchants can run into a conflict of interest if it looks like a dealer is capitalizing from a trader’s loss. With ECNs and STPs, brokers can solely profit from spreads, eliminating this risk utterly. By now, you want to know the importance of partnering with a foreign exchange liquidity provider. For this cause, reluctant brokers can cause market volatility to spiral uncontrolled. This is where the importance of having a forex liquidity partner becomes clear.

A core liquidity provider is an intermediary that trades significant portions of assets to assist be sure that market participants can persistently buy and promote belongings after they wish. Liquidity providers carry out essential functions out there corresponding to encouraging value stability, limiting volatility, reducing spreads, and making trading cheaper. Banks, monetary institutions, and buying and selling corporations are key players in offering liquidity to different https://www.xcritical.com/ parts of the monetary markets. Liquidity risk is a crucial factor that may significantly impact the stability of monetary institutions and markets. It refers back to the potential for an entity to come across difficulties in assembly its financial obligations as a result of a scarcity of access to enough cash or liquid belongings. This threat arises when there is an imbalance between the demand for liquidity and the supply of funds to satisfy that demand.

That may be nice if the individual can wait for months or years to make the purchase, but it might present a problem if the individual has only a few days. They may need to promote the books at a discount, instead of waiting for a buyer who’s keen to pay the total value. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street expertise as a derivatives dealer.

Banks have entry to giant amounts of capital and are able to provide liquidity at aggressive costs. They additionally offer a variety of monetary providers, together with currency conversion, hedging, and danger administration. Market liquidity threat is the commonest type of liquidity danger confronted by traders. It refers again to the threat of not being ready to buy or promote an asset rapidly sufficient, at a fair value, or in the desired amount as a end result of inadequate market depth. This danger is particularly prevalent in much less liquid markets, the place there are fewer consumers and sellers.

Brokers can blend elements of the previous fashions, they provide ECN entry for some property whereas they front as market makers for other traders. Electronic Communication Networks (ECNs) connect traders to quite a few LPs, they provide aggressive prices and clear execution. An unregistered security, however, is not registered with a governmental agency and is subsequently not topic to any particular regulations. Understanding these sorts of liquidity risk is essential for effectively managing them and incorporating them into funding measurement frameworks. In the next part, we’ll discover the function of liquidity risk in portfolio construction and diversification. The time period auction facility is a software utilized by some central banks to inject liquidity into the banking system.

Brokers should evaluate the accessibility and responsiveness of the provider’s buyer support staff. Prompt and effective help in resolving points or answering inquiries is crucial for maintaining smooth buying and selling operations. Compliance with new rules could necessitate adjustments to operational processes, doubtlessly impacting liquidity provision. Additionally, tighter spreads are inclined to correlate with reduced instances of slippage, which is the difference between the expected commerce price and the precise executed price. Let’s find out what a liquidity provider is and what to consider when selecting a dependable liquidity provider. Alexander Shishkanov has several years of experience in the crypto and fintech industry and is enthusiastic about exploring blockchain expertise.

They want to have the flexibility to borrow cash at a reasonable value to fund their operations and meet the wants of their customers. Relationship liquidity refers again to the availability of credit or funding from monetary institutions or other traders. It is the flexibility of an investor to lift cash or credit score by way of personal or business relationships.

Incentivized liquidity swimming pools may be an excellent alternative for users to maximize their returns and take part in exciting token launches. Currency swaps are agreements between central banks to exchange currencies for a particular period. For example, if a bank in the United States wants euros to fund its operations, it might possibly borrow euros from the eu Central bank (ECB) by way of a forex swap agreement. This helps to guarantee that banks have entry to the currencies they should function. It refers to the ease with which an investor can purchase or promote an asset with out affecting its price.

EMMs normally have a high stage of automation and do not require human intervention of their operations. Retail Aggregators – Retail aggregators are platforms that mixture retail orders and ship them to liquidity suppliers. They supply entry to institutional liquidity and competitive pricing to retail traders. Retail aggregators are often most well-liked by small retail traders who can not entry institutional liquidity instantly.