If the purchase is made in cash, credit the Cash account to decrease the company’s cash on hand, showing that cash has been spent to acquire inventory. It is the management’s obligation to review the inventory valuation on the balance sheet. On 05 Apr 202X, company has found that an inventory of $ 2,000 needs to write off due to damage. Inventory on hand needs to present at a lower cost or net realizable value which is conservative accounting. It prevents the company from overstating the assets and understating liability.

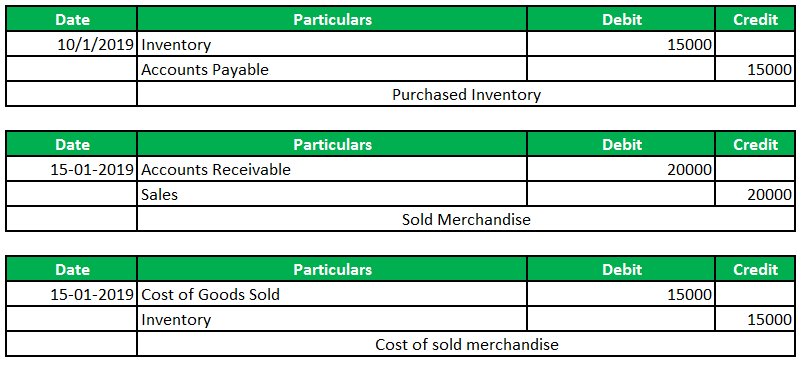

Transaction Upon Selling

- But while the circumstances for both share commonalities, one particular distinction must be understood.

- Implementing a segregation of duties within the inventory management process is a vital internal control measure.

- If you buy $100 in raw materials to manufacture your product, you would debit your raw materials inventory and credit your accounts payable.

- The first step in making adjusting journal entries for inventory is to conduct a thorough physical count of the inventory on hand.

At the end of an accounting period, businesses must close their books to finalize their financial statements. This process involves ensuring that all transactions for the period have been recorded and that the accounts accurately reflect the company’s financial position. It ensures that inventory balances are correct and that the cost of goods sold (COGS) is accurately reported.

Best Practices for Recording Inventory Journal Entries:

It’s not unusual for a business to not sell off the products in its inventory. Businesses even anticipate a certain percentage of their inventory stock may spoil, become damaged, go out of season, or become unsellable for some reason. Your finished goods entry helps you to compare the cost of completed goods with those still in production. Your WIP account indicates goods that have progressed through the manufacturing stage but are still not ready for sale. Indirect labour costs are the wages for employees such as maintenance staff, technicians or managers who assist the direct labour employees to do their jobs but aren’t directly involved in the product production.

Inventory journal entries

The periodic inventory system is a method of accounting for inventory that involves taking physical counts of inventory at regular intervals and updating the inventory accounts accordingly. In this method, periodic inventory system journal entries are made to record the purchase, sale, and ending inventory balances. In conclusion, accurate inventory adjustments are essential for maintaining the accuracy of financial records and the overall health of a business.

If you are operating a production facility, then the warehouse staff will pick raw materials from stock and shift it to the production floor, possibly by job number. This calls for another journal entry to officially shift the goods into the work-in-process account, which is shown below. If the production process is short, it may be easier to shift the cost of raw materials straight into the finished goods account, rather than the work-in-process account. If you sell products at your business, you likely have some form of inventory. Knowing how much inventory you have on hand, as well as how much you need to have in stock, is a crucial part of running your business.

Inventory assets are recorded in your account ledger as debits when their value increases and entered as credits when their value declines. Different categories of accounts are recorded on either side of the accounting ledger. Each transaction is recorded on both sides of the accounting ledger when the value increases and on the opposite side when the value decreases. Companies will either manufacture products to sell or purchase inventory from their suppliers.

Accurate inventory journal entries are essential for maintaining accurate accounting records, complying with tax reporting requirements, and making informed business decisions. By maintaining accurate inventory records, businesses can improve their financial performance, reduce the risk of errors, and operate more efficiently. One common mistake in inventory management is overlooking small discrepancies. Even minor differences between recorded and actual inventory can indicate underlying issues such as theft, misplacement, or recording errors.

Spoilage incurred through accidents, damage, or theft is charged as an expense. There are many journal entries that must be made to record the movement of inventory. Usually, a bookkeeper will be entering this information in the general ledger’s inventory journals for all of the products that you manufacture (if you don’t have a bookkeeper, generally the owner makes the entries). A chart of accounts lists each account type, and the entries you need to take to either increase or decrease each account. After you receive the raw materials, you will eventually use them to create your product.

Inventory directly affects the income statement through the cost of goods sold (COGS). The method chosen for inventory valuation (FIFO, LIFO, Weighted Average) impacts COGS, which in turn affects gross profit and net income. Accurate inventory accounting ensures that COGS is correctly reported, leading to a 2 2 perpetual v. periodic inventory systems financial and managerial accounting true reflection of profitability. Incorrect inventory valuation can distort gross profit, operating income, and net income, potentially misleading stakeholders about the company’s performance. The Weighted Average Cost method calculates an average cost for all inventory items available during the period.